Which One Should You Choose?

When you buy a property, you think about the location, the renovation budget, and the monthly loan repayment. But there’s one important thing many homeowners overlook on how to protect your mortgage if something unexpected happens.

That’s where MRTA, MRTT, MLTA, and MLTT come in. All four are designed to protect your home loan in case of death, total permanent disability (TPD), or in some cases critical illness but they work differently, and the benefits you get will vary.

1. MRTA – Mortgage Reducing Term Assurance

What It Is:

MRTA is a conventional insurance plan that covers your outstanding mortgage loan. The coverage reduces over time as you repay the loan.

Key Features:

- Single Premium

Usually paid upfront (often added to your home loan). - Decreasing Coverage

Coverage amount reduces as your mortgage balance goes down. - Tied to Your Loan

Cannot be transferred if you refinance or buy a new property.

Best For:

- Those with no other insurance or protection options.

- When it's required as part of the housing loan offer.

- Those who can comfortably pay a lump sum upfront.

2. MRTT – Mortgage Reducing Term Takaful

What It Is:

MRTT works exactly like MRTA, but it’s Shariah-compliant. Instead of insurance, it’s structured as Takaful, a cooperative risk-sharing arrangement.

Key Features:

- Shariah-Compliant

Meets Islamic finance principles. - Decreasing Coverage

Just like MRTA, coverage decreases over time. - Single Contribution

Paid once at the start of the coverage (often financed in the loan).

Best For:

- Those with no other insurance or protection options.

- When it's required as part of the housing loan offer.

- Those who can comfortably pay a lump sum upfront.

3. MLTA – Mortgage Level Term Assurance

What It Is:

MLTA is a conventional insurance plan that provides level coverage, meaning your sum assured stays the same throughout the policy term, even as your loan balance decreases.

Key Features:

- Level Coverage

Same payout amount regardless of when you claim. - Transferable

Can continue if you refinance or change properties. - Cash Value

Some plans offer a savings or investment component.

Best For:

- Buyers who want flexible, long-term mortgage protection.

- People who may refinance or buy new properties later.

- Those who want extra financial benefits in addition to mortgage coverage.

4. MLTT – Mortgage Level Term Takaful

What It Is:

MLTT is the Shariah-compliant version of MLTA. It offers level coverage and works under Takaful principles.

Key Features:

- Shariah-Compliant

Suitable for Muslim homeowners. - Level Coverage

Same payout amount throughout the policy term. - Transferable

Continue coverage even if you refinance or change properties. - Potential Surplus Sharing

May receive a portion of the surplus if claims are low.

Best For:

- Muslim buyers looking for flexible, Shariah-compliant protection.

- Those who may refinance or change properties in the future.

Comparison Table

| Feature | MRTA | MRTT | MLTA | MLTT |

| Coverage Type | Decreasing | Decreasing | Level | Level |

| Premium Payment | One-time | One-time | Monthly / Yearly | Monthly / Yearly |

| Transferable? | No | No | Yes | Yes |

| Cash Value | No | No | Yes (some plans) | Yes (some plans) |

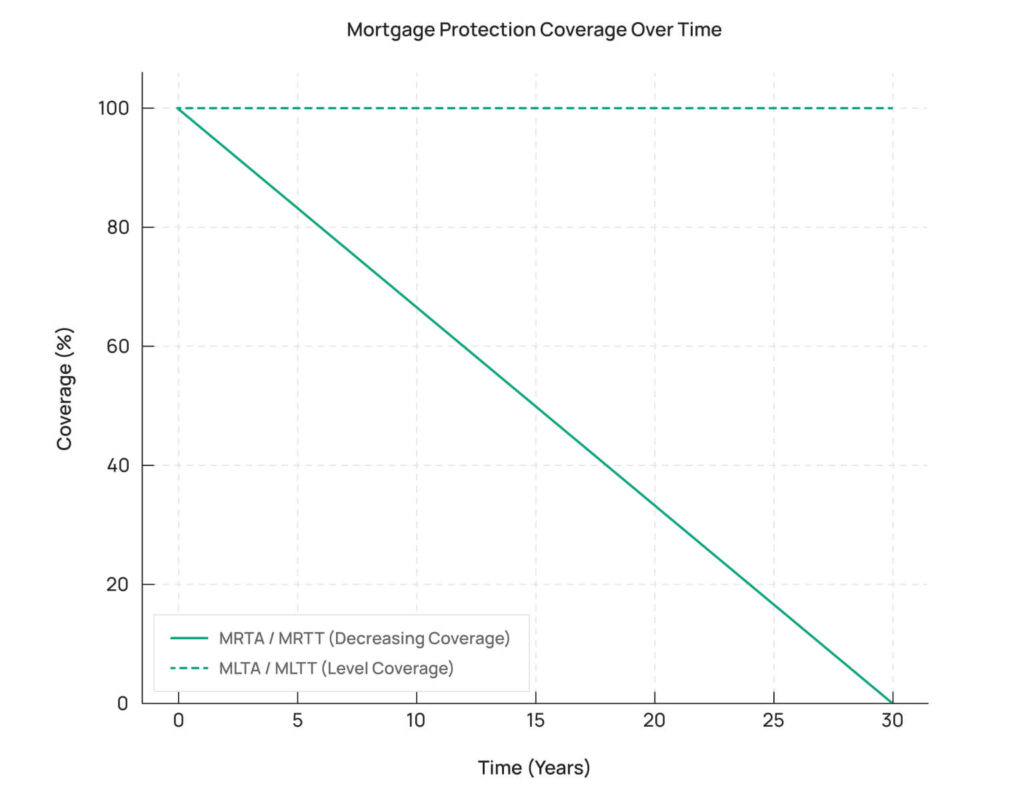

Above is a simplified chart showing the difference in coverage between MRTA / MRTT and MLTA / MLTT:

Key Features:

- MRTA / MRTT

Coverage reduces over time, following your loan balance. - MLTA / MLTT

Coverage remains level for the full policy term, even after most of your loan is repaid.

Impact of Base Rate / OPR Rate Changes

When the Base Rate or OPR Rate changes, your home loan interest may increase, causing your loan balance to be higher than originally projected.

- MRTA / MRTT

Since coverage reduces over time, it may not match your actual loan balance if interest rates go up. This means your beneficiaries might have to top up the remaining loan amount. - MLTA / MLTT

Coverage stays constant, so if your loan balance is higher than expected, the payout still covers it fully. Any excess payout after settling the loan goes directly to your beneficiaries for living expenses or other needs.

Important Facts About Medical History & Eligibility

- Not everyone is eligible for every plan. People with existing medical history may face application rejections.

- Some insurers occasionally offer Guaranteed Issue Offers (GIO), most common can be found in MLTA, allowing applicants with health conditions to get coverage without full medical underwriting.

- Full disclosure is critical even for minor medical history.

- You must declare your health history when applying for MRTA, MRTT, MLTA, or MLTT.

- Non-disclosure is risky while you might get coverage easily at first, claims can be denied if the insurer discovers non-disclosure during a claim review.

- This could leave your beneficiaries with no payout, and the policy could be void due to a breach of contract.

Don’t Fall for This Common Myth

You might hear:

“My banker said I can be covered even if I have a medical history, just don’t declare it.” OR “My agent told me it’s okay, they will still approve me without asking for details.”

This is a dangerous misconception.

If you do not declare your medical history:

- The insurer has the right to reject your claim later.

- You risk paying for a policy that will never pay out when you need it most.

- You place your family in a position where they might still have to settle the outstanding loan themselves.

Bottom line:

Always declare your medical history honestly, no matter how small you think it is. It’s the only way to ensure your coverage is valid and your loved ones are protected.

Why This Matters

Choosing the right mortgage protection plan can make the difference between your family keeping the home or losing it if something unexpected happens.

At MET Advisory, we help you compare MRTA, MRTT, MLTA, and MLTT so you can make the best decision based on your loan, lifestyle, and financial goals.

Want to know which one suits you best?

Email us at enquiry@metadvisory.my or DM us on Instagram for a personalised consultation.