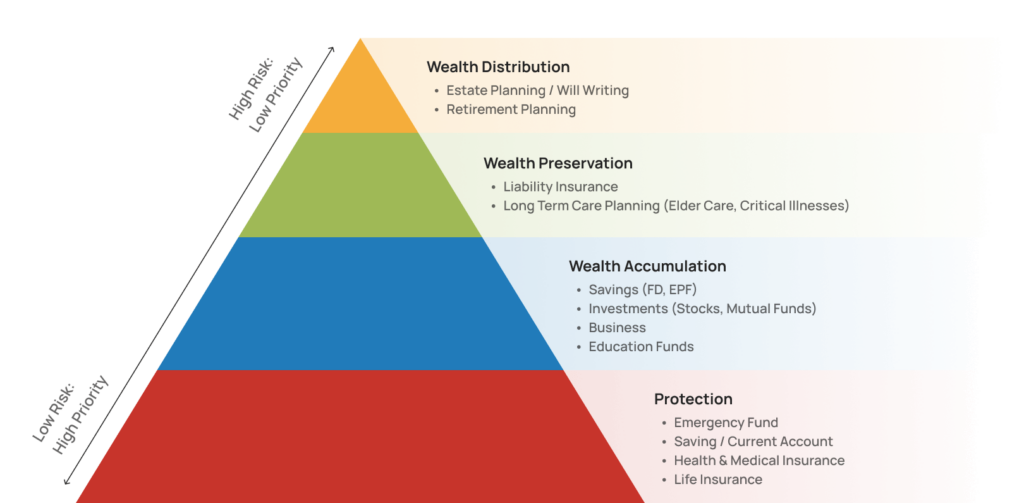

Wealth Management is not as simple as it may seem. It consists of various components including Financial Planning, Investment Management, Risk Management, Tax Planning, Estate Planning, Retirement Planning, Wealth Preservation, and more.

Overall, wealth management is a holistic approach to financial planning that integrates various financial disciplines to help individuals and families build, preserve, and transfer wealth across generations.

Wealth Management Pyramid

Understanding Insurance Needs

Only 56% of Malaysians are insured by life insurance, according to liam.org.my. While many are aware of insurance, there is often a lack of understanding about its role in financial planning.

- Basic Insurance

For example, Hospital & Surgical insurance, also known as Medical Insurance, is essential. The awareness of Medical Insurance is increasing, but many still don't fully understand its benefits.Consider this example:

Mr. A earns RM 5,000 monthly and has RM 25,000 in savings. He contracts dengue, requiring hospital treatment costing RM 3,000. Without insurance, he pays the bill from his savings or income. With insurance, he only pays a monthly premium of RM 180, significantly less than the hospital bill, and retains peace of mind. - Moving Beyond Basic Insurance (Wealth Accumulation)

Once basic protection planning is in place, the focus shifts to Wealth Accumulation. Many remain in this stage, lured by the promise of high returns from investments for example, fixed deposit, stocks, unit trust investment and etc. The sense of security of having the compounding gains will make the financial planning looks beautify

as how it is.

- Wealth Preservation

However, the next crucial step is Wealth Preservation. Unforeseen circumstances can erode your hard-earned wealth. Proper planning for illnesses, elderly care, and sudden death is essential.- Illness Coverage

Protects your income when you can't work due to illness. Illnesses may directly have a directly negative impact on your capability on current works which also directly impact on your capability on earnings. - Elderly Care

Picture your retirement as a serene, worry-free garden. Elderly care policies ensure your retirement funds remain intact. Prevents your retirement funds from being depleted by nursing care costs. - Legacy Planning

Ensures your dependents are secure in the event of your sudden death. Proper legacy planning ensures your wealth provides for your dependents, giving them security and guidance even after you’re gone.

- Illness Coverage

- Wealth Distribution: A Vital Step in Estate Planning

Whether you are wealthy or not, ensuring proper wealth distribution is crucial for complete estate planning. Unfortunately, many people overlook this essential step.Without a properly documented will, your estate will be distributed according to the Malaysian Distribution Act of 1958. As illustrated in the table below, the absence of a will can lead to complications, especially if a beneficiary passes away without a will of their own. This can create ongoing legal complexities.

Ultimately, we work to support ourselves and our loved ones. It is imperative to take the initiative and plan appropriately to protect our hard-earned estates.

Distribution Act 1958

| Intestate Leaving Surviving | Entitlement |

| Spouse Only (No Parents / No Issue) | All |

| Issue Only (No Parents / No Spouse) | All |

| Parents Only (No Spouse / No Issue) | All |

| Spouse & Parent (No Issue) | Spouse 1/2 Parent 1/2 |

| Spouse & Issue (No Parent) | Spouse 1/3 Issue 2/3 |

| Parent & Issue (No Spouse) | Parent 1/3 Issue 2/3 |

| Parent & Spouse & Issue | Parent 1/4 Spouse 1/4 Issue 2/4 |

(1) This act only applies in West Malaysia & Sarawak.

(2) The following person(s) are entitled accordance to priority when an intestate dies without leaving surviving spouse,

children and parents:-

1. Brothers & Sisters, 2. Grandparents, 3. Uncles & Aunts, 4. Great Grandparents, 5. Great Uncles & Aunts, 6. Government

Simple Steps for Peace of Mind

By dedicating just 10% - 20% of your wealth to proper planning, you can secure the entire pyramid. With the right advice and planning, you can live worry-free, knowing your financial future is well taken care of.

Embark on your financial journey with confidence, building a solid foundation, growing your wealth, protecting it, and planning for the future. Your financial pyramid will stand strong, offering stability and security for you and your loved ones.