Experience Effortless Mortgage Loan Applications – Your Journey Starts Here.

At MET Advisory, simplifying mortgages is our specialty. Whether you're a first-time homebuyer, exploring subsales, or considering refinancing, we've got you covered.

Our Services

Understanding the basics required for refinance or first-home buyer loan or buying a house makes the approach easier.

We prioritize a personalized approach to financial applications. You do not need to visit multiple banks to get the best deal, by coming to our services, we analyze and identify the banks that best suit your profile. This tailored strategy minimizes the chances of rejection.

Our goal is to secure approvals that match your profile. Below are the bank lending guideline in Malaysia.

The key information includes:

Employment Type

Business owner, salary earner, commission earner.

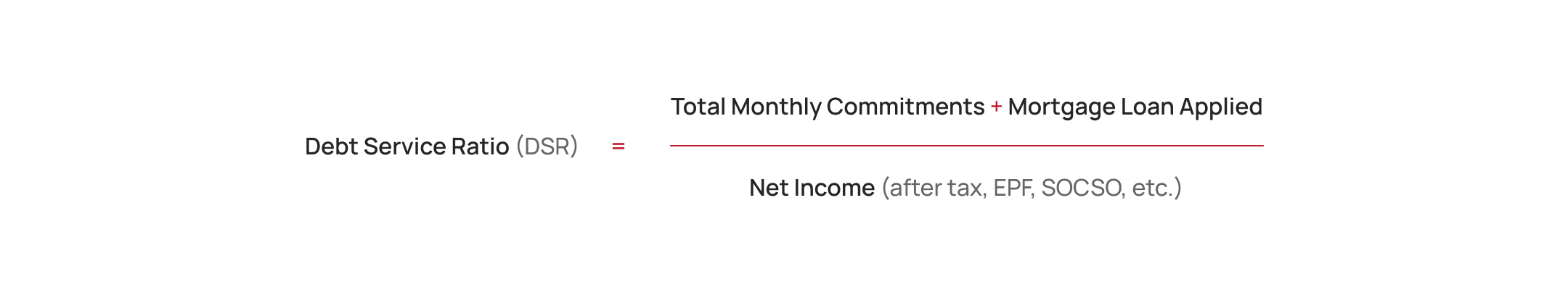

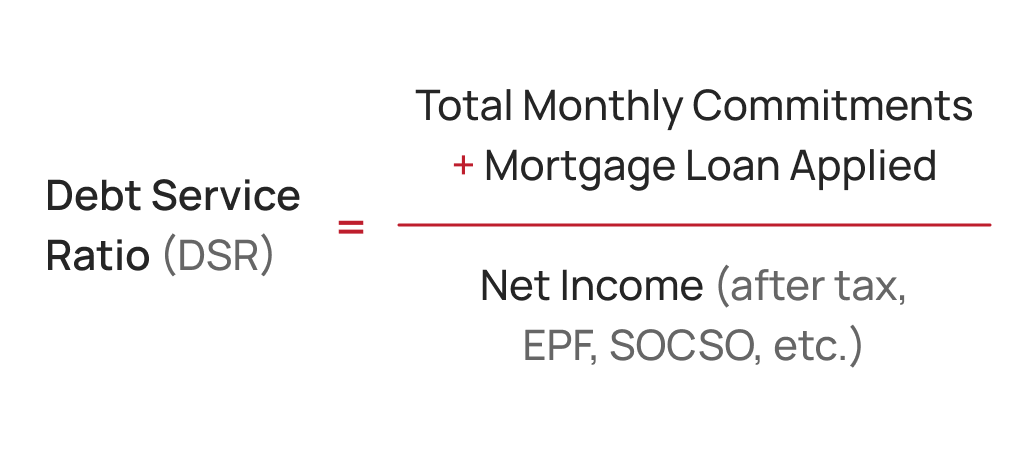

Debt Service Ratio (DSR)

It includes your total monthly instalments over your monthly net income.

CCRIS

CCRIS report is the key to loan application.

MRTA / MLTA

Understanding mortgage insurance coverage selections for your loan.

We’ll go the extra mile to help secure a home loan that’s right for you.

Fast Response

We are with you for the life of the loan. We often help customers with multiple loans over time and provide assistant whenever needed.

No Hidden Charges

We don't charge to find the right home loan for you. We got paid by the bank once your loan is released.

Reliable Information

We present the options and the facts, to help you secure the right home loan.

One-stop Solution for All Financial Services

We keep the application process simple by managing the paperwork on your behalf right through to loan release.

Partnering with licensed banks, we will get the best interest rates tailored to your specific profile! Let us guide you through a seamless journey towards your application.

2009

MET Advisory was set up

14+

Years of experience

200mil.

Approvals in a year

12+

Bank partners

Debt Service Ratio (DSR)

It means that a method used by banks to calculate whether you can afford the loan you’re applying for.

In general, this formula essentially helps the bank estimate how much you can still afford to fork out for your monthly instalments.

Your DSR is then compared against the bank’s maximum allowable DSR limit, and if your DSR doesn’t exceed the limit, you’re one step closer to receiving the home loan you applied for.

In fact, every bank has their own distinct requirements depending on the individual profile, so while certain banks may accept a DSR as high as 80%, others might cap it at only 50%.

Don’t get confused just yet! Here’s an example of what the formula looks like:

Central Credit Reference Information System (CCRIS)

We always heard of CCRIS Report, it is a system created by Bank Negara Malaysia’s (BNM) Credit Bureau to provide standardized credit report on potential borrower.

What’s included in the CCRIS report? It includes the borrower’s outstanding credits, special attention account and applications for credit within the last 12 months.

How do I get the CCRIS Report? There are a few ways to get your up-to-date report in the market. We always encourage to visit the eCCRIS Portal as it is the helpful CCRIS online platform that provides simple and secure access to your CCRIS Report whenever you need, and it’s free!

MRTA / MLTA

In Malaysia, there are two types of insurance offered for housing loans.

Which is more cost effective for you? Each comes with different perks and disadvantages.

Table

MRTA

MLTA

Protection Level

Reduces throughout the loan tenure

Stay consistent throughout the loan tenure

Transferability To Other Property

No

Yes. It can be attached to any loan

Cash Value / Cash Back

RM 0 at the end of tenure

With Cash Value throughout the policy premium

Beneficiary

Bank Only

Anyone

Coverage Options

Death

TPD

Death

TPD

Critical Illness

With our strong financial consultation experience, in-house legal advisors and licensed consultants, our specialised departments provide comprehensive one-stop solutions to our valued clients.

We have been in business since 2009, MET Advisory Malaysia Sdn. Bhd. stands as a premier financial advisory firm which includes services related to Mortgage, Estate and Trust. We take immense pride in our dedicated team of seniors’ specialist who diligently handle all clients.

Documents Checklist

- NRIC copy

- 6 months pay slips / commission slip / payment voucher

- 6 months salary bank statement

- Detailed EPF statement

- EA Form / Borang BE with tax receipt

- Supporting documents (fixed deposits, savings, shares, rental)

- NRIC copy

- Company SSM registration full set (Sole proprietor & partnership)

- Form 9, 24, 49 (For Sdn. Bhd.)

- 6 months company bank statement

- 3 months pay slips (If applicable)

- Salary bank statement (If applicable)

- Detailed EPF statement (If applicable)

- 2 years of Borang B with tax receipt

- Supporting documents (fixed deposits, savings, shares, rental)

For any inquiries or to get started on your home loan application, reach out to us today.

Head Office

Phone

Copyright 2025 © MET Advisory Malaysia Sdn. Bhd.